Rimi, Your Lifetime Wealth Partner

“Most people don’t plan to fail, they fail to plan”

J. L. Beckley

Hello, I'm Rimi. An Independent Wealth Planner based in Bangkok, Thailand.

For 20 years I have helped Individuals and Families plan their Retirement, Tax, Inheritance, Education, and Health Protection goals.

I provide a one stop service for my clients, from uncovering financial needs, creating personalized financial plans and execution of the plans. I work with key wealth management partners to offer the ideal products for my clients and if necessary, can also refer to other professionals.

As a mother myself, I understand the importance of family. The needs worries and concerns that you may have with regards to family protection and wealth planning.

No matter if you are looking to fund your dream retirement, or managing and transferring your family’s wealth and estate to your loved ones. It is my job to remove that burden from you, so you can enjoy your life worry free.

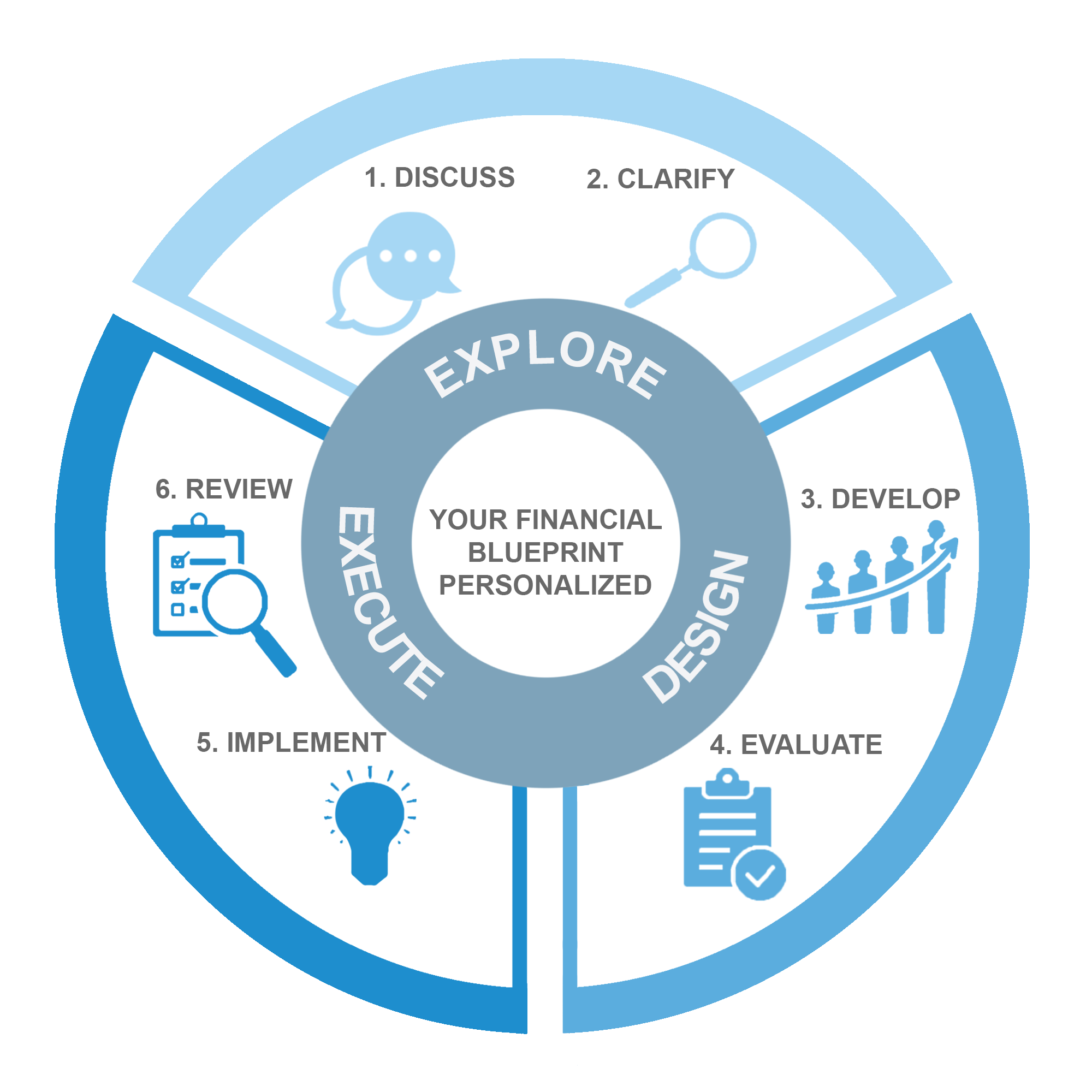

Your Step -by- Step Financial Journey

I am an advocate of the 6 steps of financial planning. It is a tried and tested process used by the best financial planners, when creating and implementing financial plans for their clients.

Step 1: Discuss

This is a discovery meeting. I need to find out about you, your needs and wants, the purpose of money must follow the purpose of life, not the other way around. I need to “Know where you stand” It is important to understand your current financial situation and your life priorities.

Step 2: Clarify

Based on the gathered information, I will help you develop your financial goals mapped on a timeline.

We will do a fun number drilling game to reach an agreeable and satisfactory goal.

Step 3: Develop

Based on the needs uncovered and the agreed financial goals, I will create your personalized Master Financial Plan. This will be your lifetime financial blueprint to kickstart your financial goals execution. Keyword here is development. Making sure we develop the right plan that will meet your goals. We will then work on what is required to make the appropriate recommendations for the required strategies and financial products.

Step 4: Evaluate

We meet and go through what I have put together for you. I will run through the pros and cons of the options available. I will help you to prioritize your financial goals based on your current financial situation so that it is easier for you to make an informed decision. You take the time to assess, calculate and discuss with your partner or relevant family members.

Step 5: Implement

Based on your feedback, we go on to create a final version of the action plan which entails the product plan, fund allocation with implementation timelines and the prioritized goals. We then kickstart the plan based on agreed execution strategies, making the implementation plan simple and easy to execute.

Step 6: Review

Life is always on a move so with time there will always be adjustments and changes to your financial goals. Hence, we will do a needs analysis and portfolio review on an annual basis. This process is circular, and I am here to go through that with you.